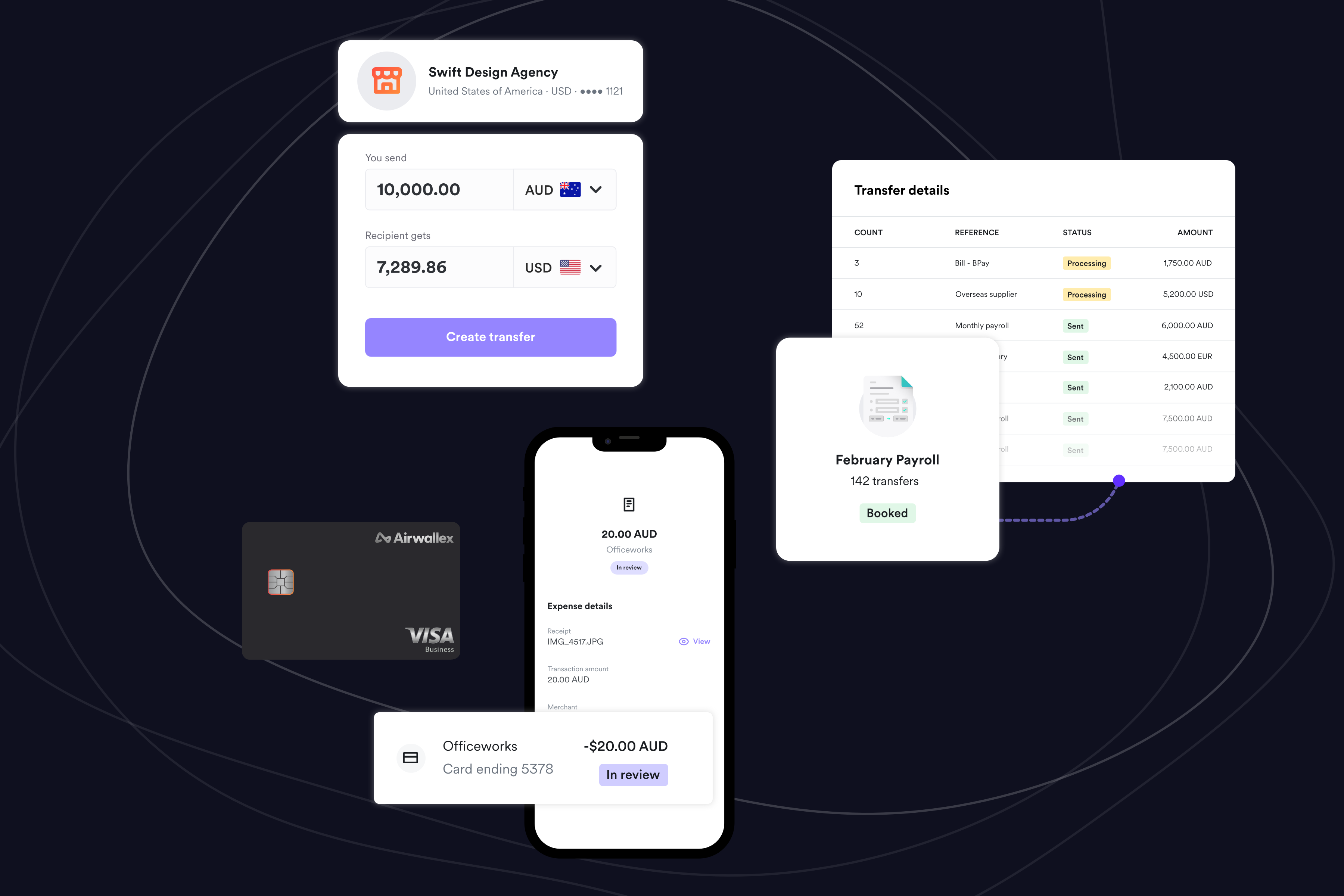

Airwallex is a financial technology company that offers a range of products designed to simplify payments and financial operations for digital businesses of all sizes. From virtual accounts to online store integrations, their goal is to offer a suite of services that scale with online businesses and enable them to grow beyond borders.

As the first design hire on the core banking team, I led the design of essential financial systems that enable customers to use Airwallex as the primary bank for their business. By providing a superior banking experience that caters to modern business needs, the goal was to drive growth in total deposits and currency conversions.

As businesses increasingly adopt digital-first strategies with global expansion goals, there is a growing need

for modern banking solutions that can scale effectively and enable seamless cross-border payments and

multi-currency transactions.

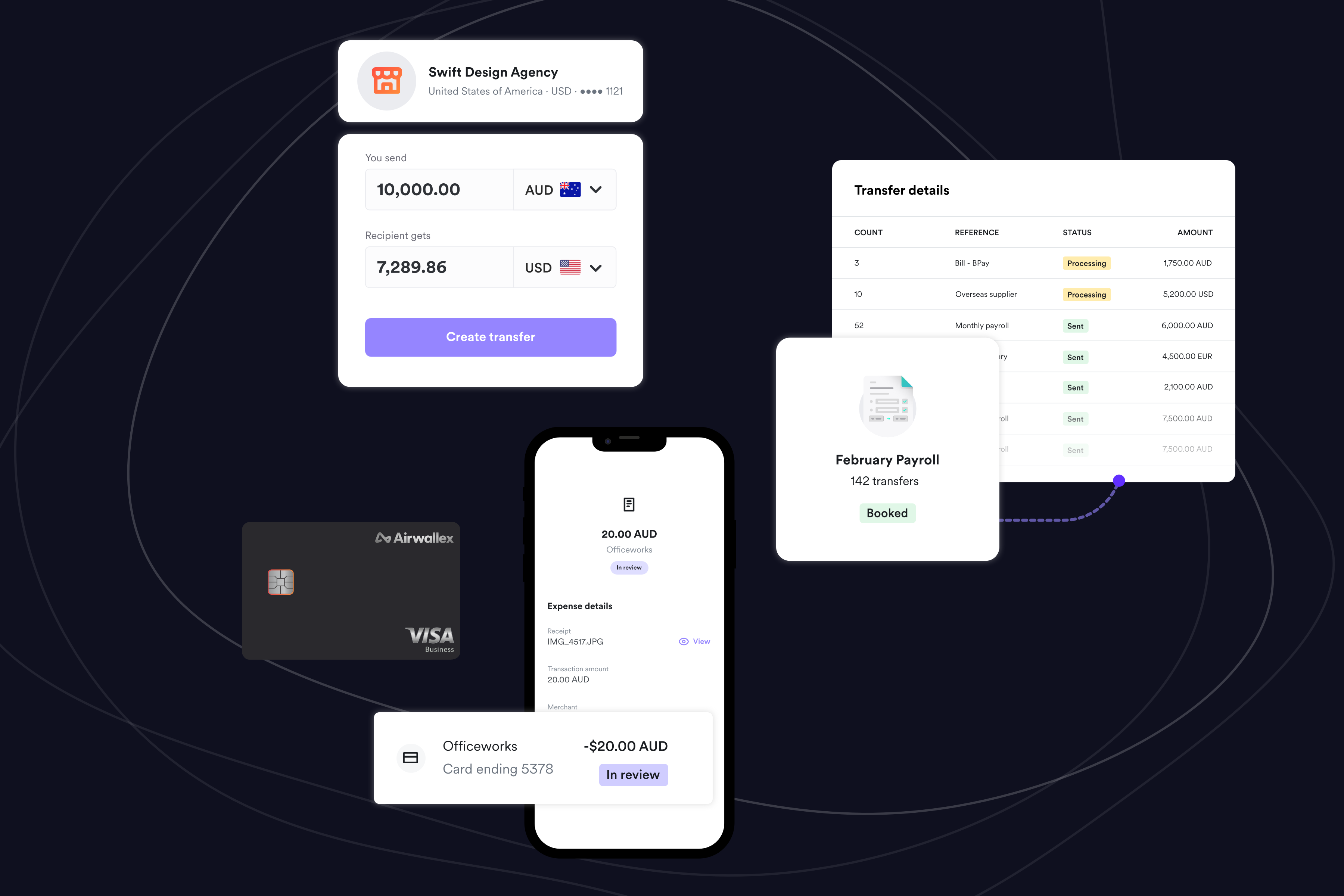

At Airwallex, I collaborated closely with customers to design wallet and virtual account functionalities that

enable users to effortlessly monitor currency balances and maintain real-time visibility into their financial

position. Additionally, users can quickly create international accounts directly from the dashboard and

seamlessly integrate them into their existing business workflows.

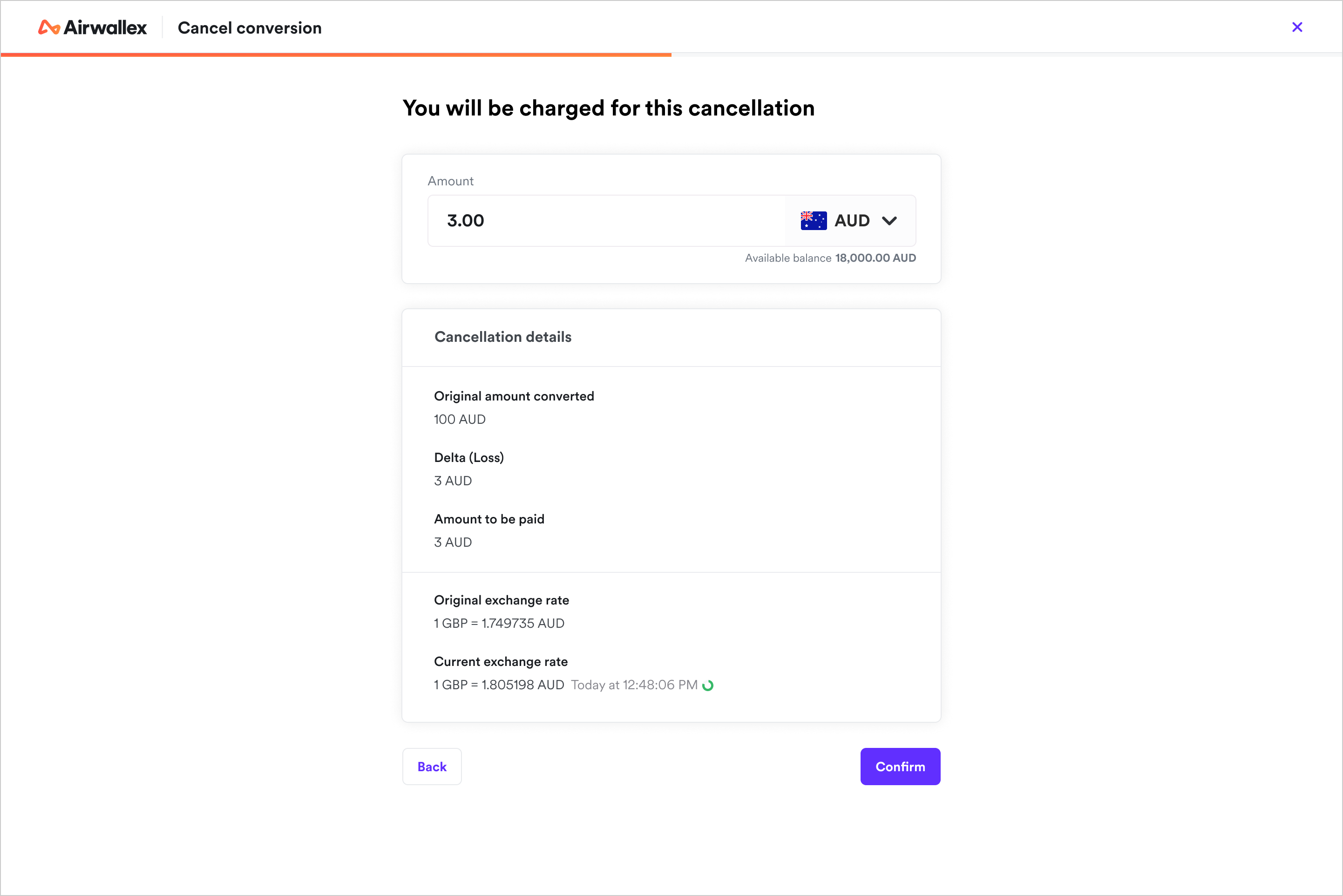

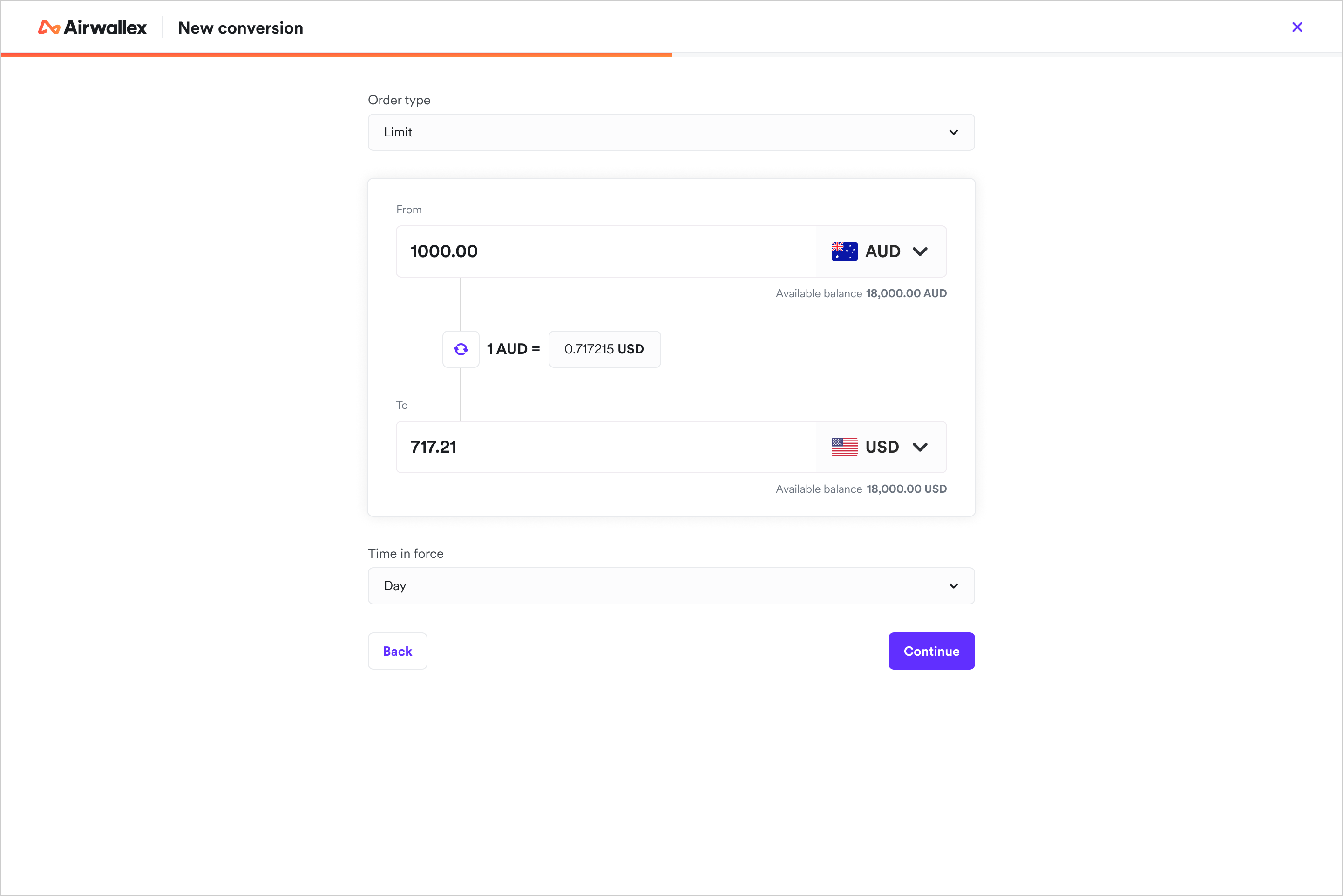

Small business owners often find it challenging to manage and

convert currencies. Most traditional banks provide FX services that

are clouded with hidden fees or markups with few cost-saving

alternatives that meet their needs. Across multiple research studies

and interviews, customers were increasingly requesting for more

control over their FX trades and voiced the need for more advanced

features. Moreover, cancellations were not built into the exisiting app and

had to be made manually.

To address these issues, I drove projects to extend currency

conversion capabilities to include Limit Orders and Cancellations.

These provide additional flexibility and transparency to clients,

allowing them to convert as they wish and have better management of

their conversions without being hit with unexpected charges.

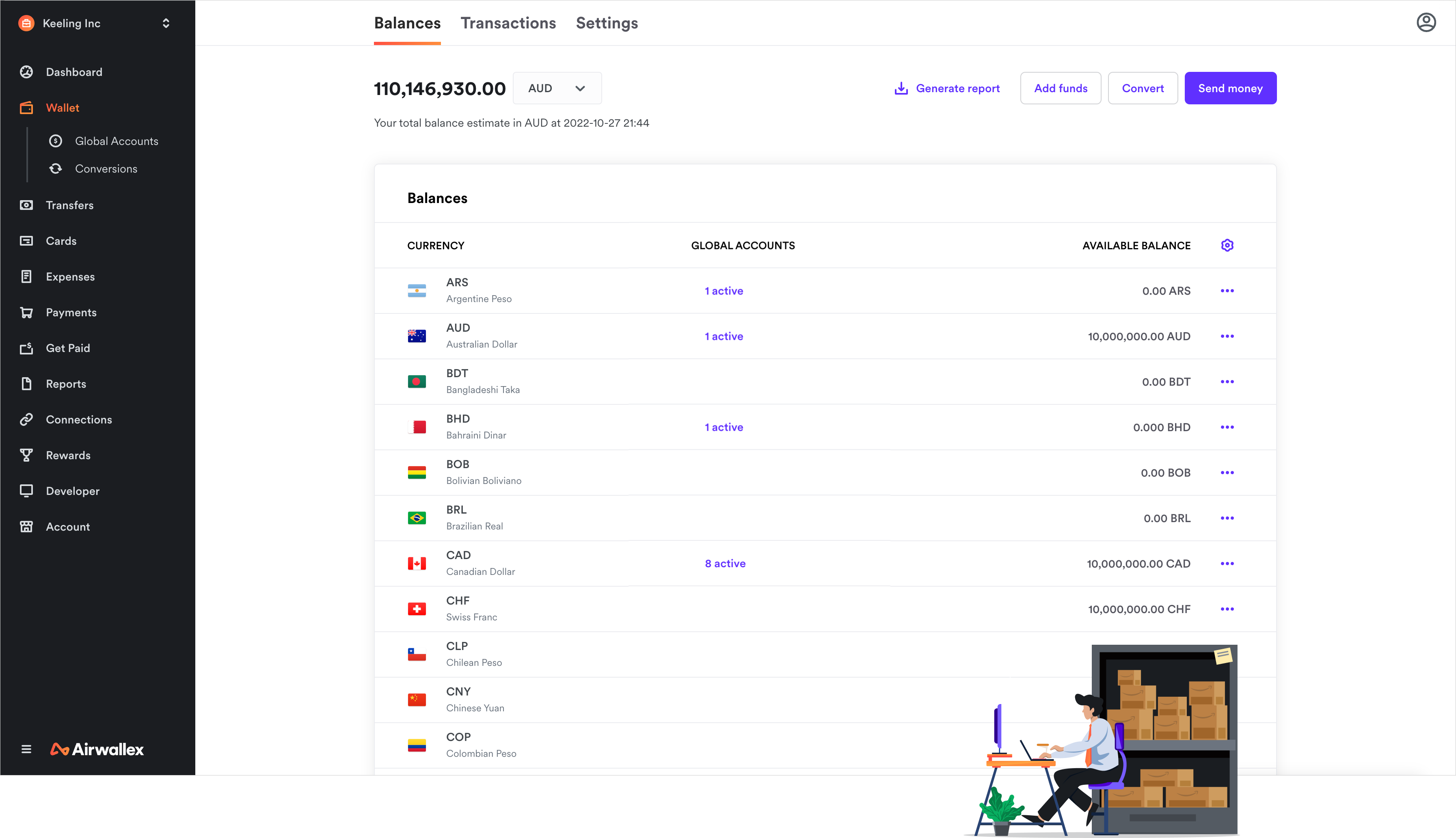

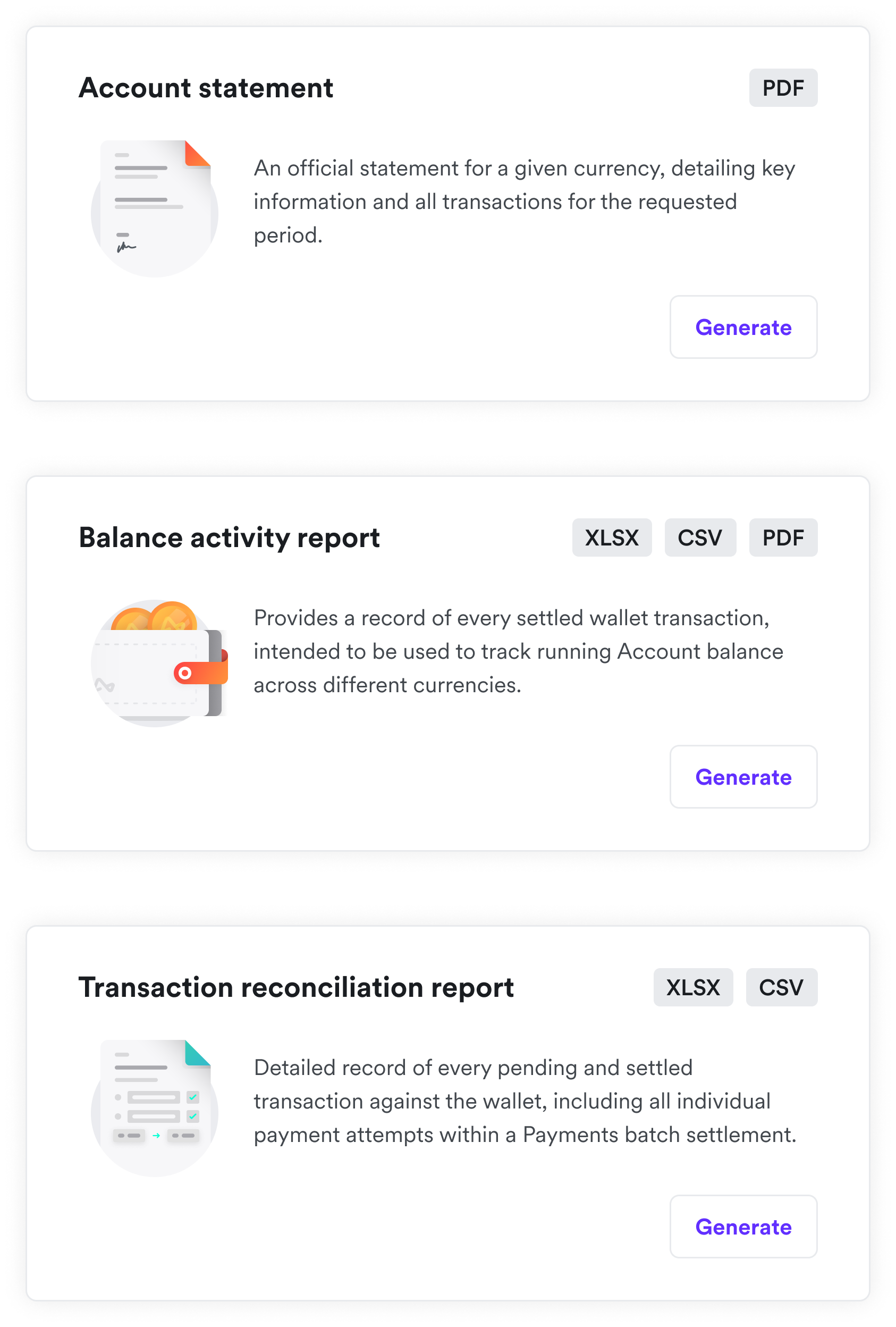

Reports are essential for business operations. Whether presenting statements to regulatory authorities,

demonstrating company ownership, or performing account reconciliation, business owners require comprehensive

reports of their account activity to meet various operational and compliance needs.

Working closely with the engineering team, I helped transform a sluggish and error-prone synchronous system

into a seamless asynchronous experience that generates reports in the background. Once reports or statements

are ready, users receive notifications and can return to download their files. A redesigned interface also

helps users easily identify which report type best serves their specific needs.

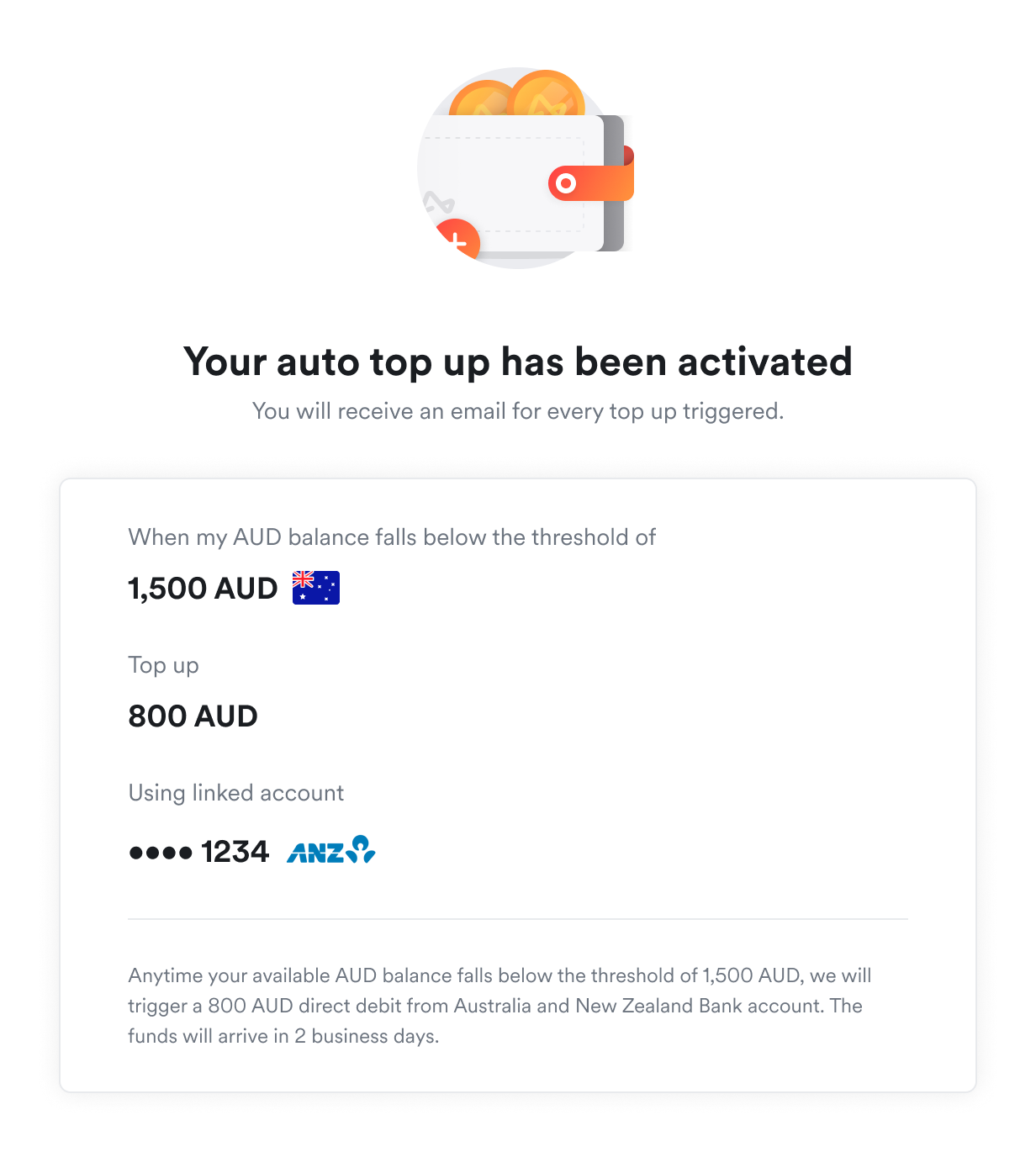

Account funding is an important part of the user experience and a key feature that should work smoothly. Users

generally need to fund their accounts before making payments and transfers, while maintaining adequate

funds to cover their regular business expenses.

To streamline the funding experience, I designed an automated top-up feature that ensures customers maintain

sufficient balances for recurring bills and payments. When account balances fall below predefined thresholds,

the system automatically pulls funds in from a designated external bank account.

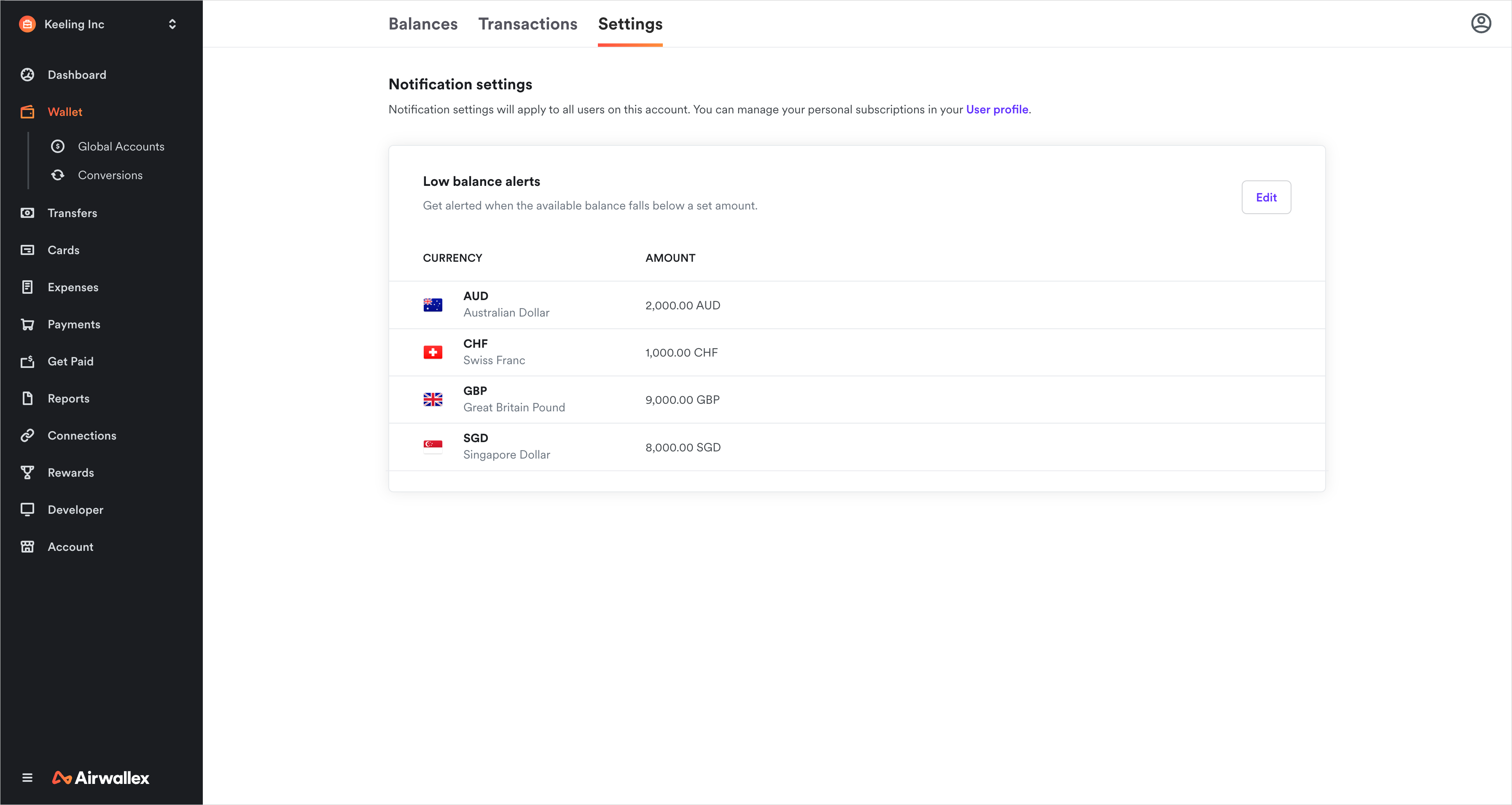

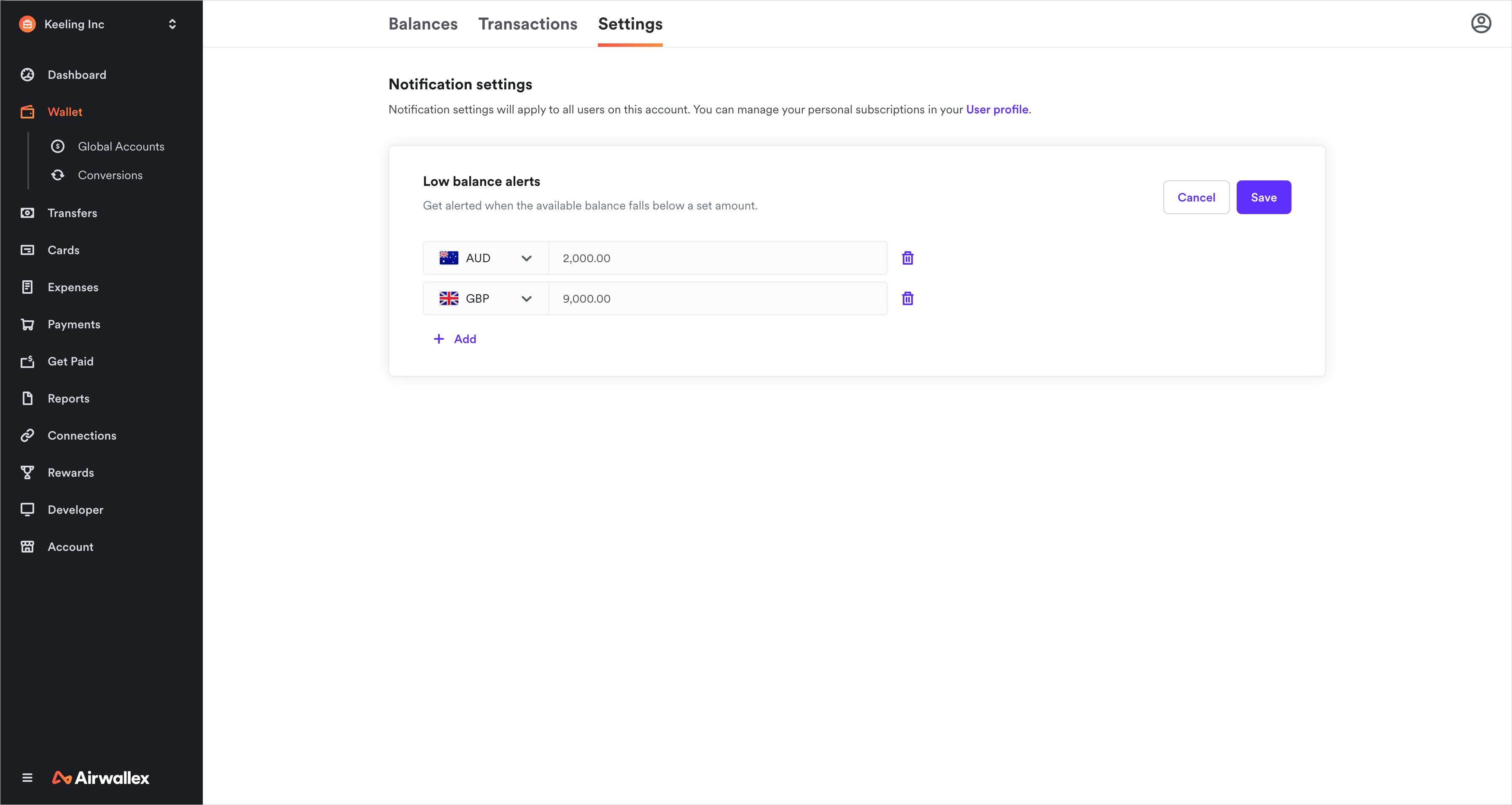

Operating across multiple currencies and managing fund movements presents significant operational challenges.

Through extensive customer research and in-depth interviews, it became clear that automated alerts were

essential when currency balances fell below defined thresholds. This capability would provide users with

timely notifications, enabling them to take proactive financial actions.

Collaborating with cross-functional stakeholders, I helped establish a robust

notification framework capable of delivering alerts optimally. This system prevents late

payments and transaction declines due to insufficient funds, ensuring uninterrupted business operations.

These efforts and refinements to the core banking experience

contributed to significant growth in account balances and currency

conversions, surpassing initial goals and targets. It also helped

position Airwallex to become the primary bank of choice for

clients globally.

In my first year with the company, I helped drive an increase of

over US$300 million in the total wallet balance and achieved over

74% YOY increase in total new deposits.