Integrating sources

Integrating Sources

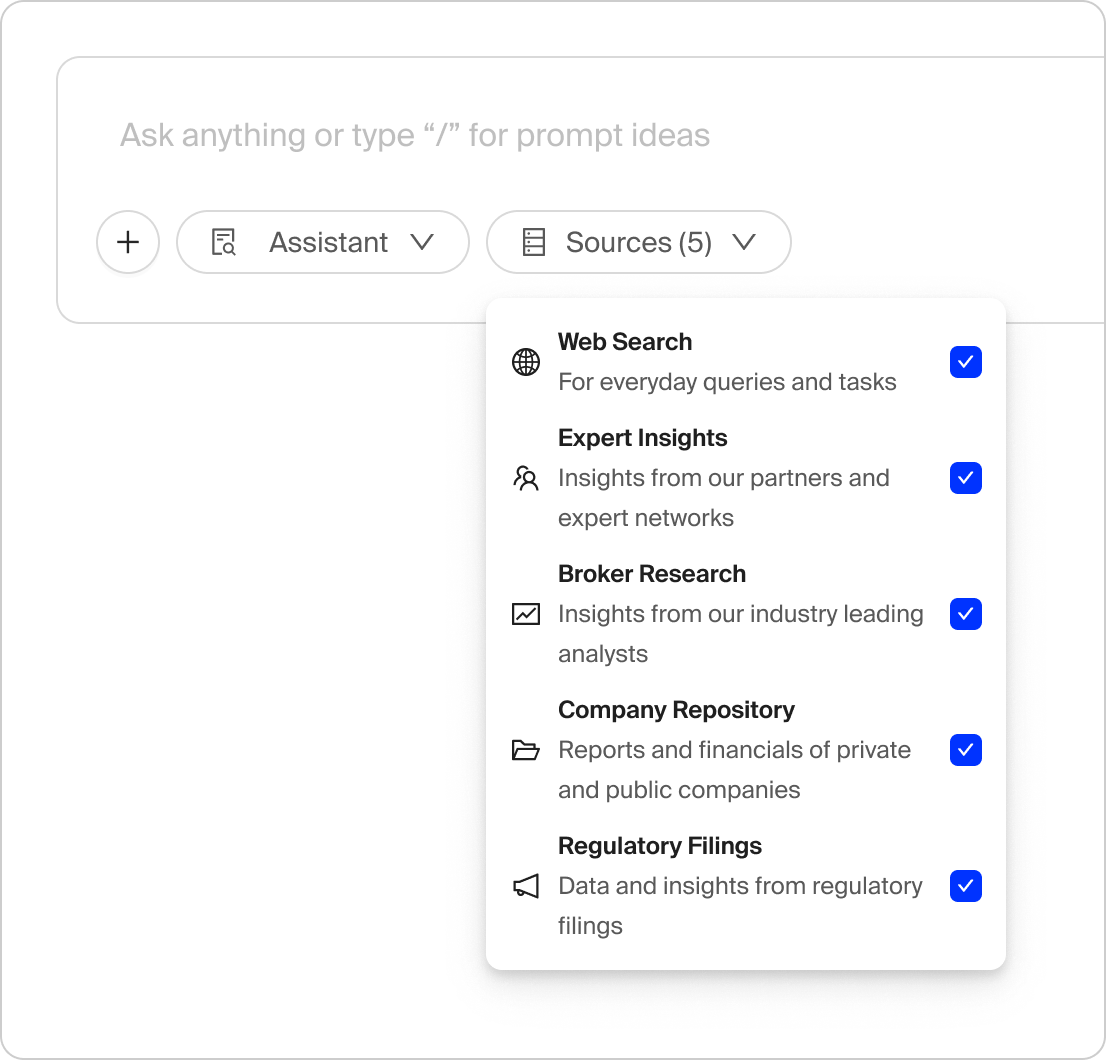

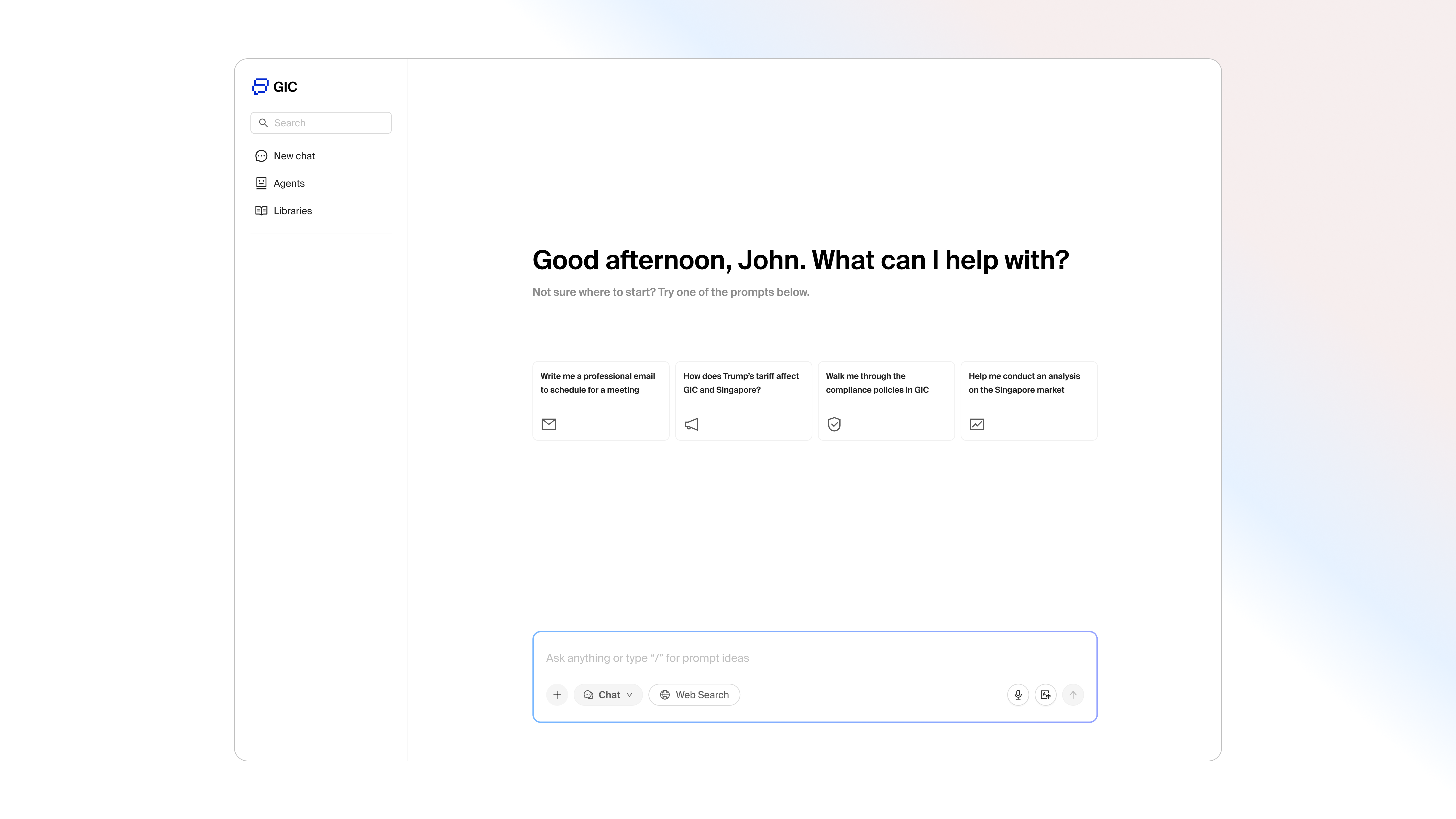

Investment professionals need access to diverse data sources to make informed decisions.

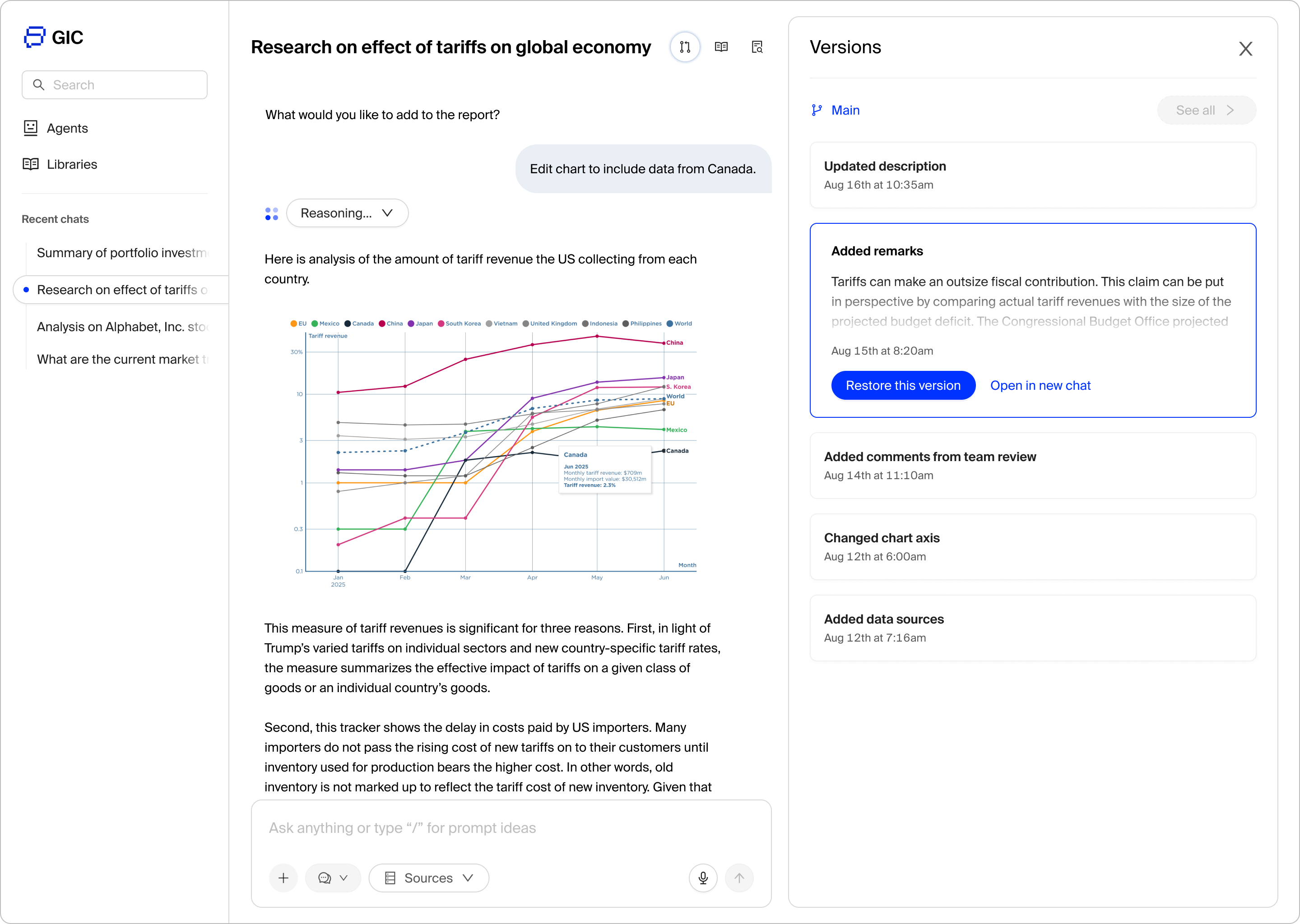

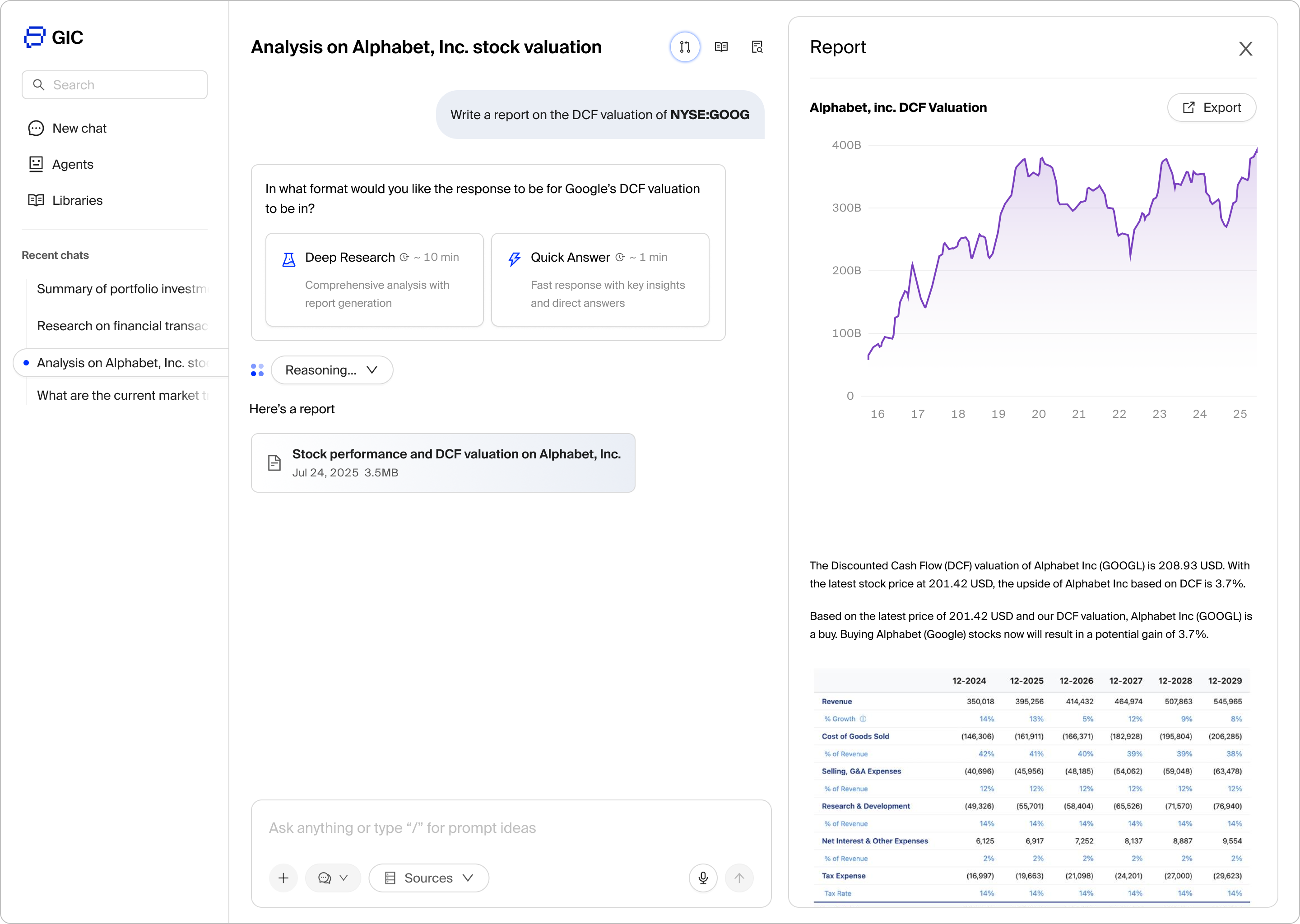

To ensure that the AI platform draws on accurate and audited data sources, I designed a unified data

integration layer that seamlessly connects to internal proprietary

databases, external market feeds, and third-party research platforms.

The feature also intelligently processes financial data with content

such as news, reports, and regulatory filings. This allows analysts to quickly

surface relevant insights and signals from multiple sources

instead of manually piecing information together from disparate systems.