Context

Context

Why build a recurring investment feature at all?

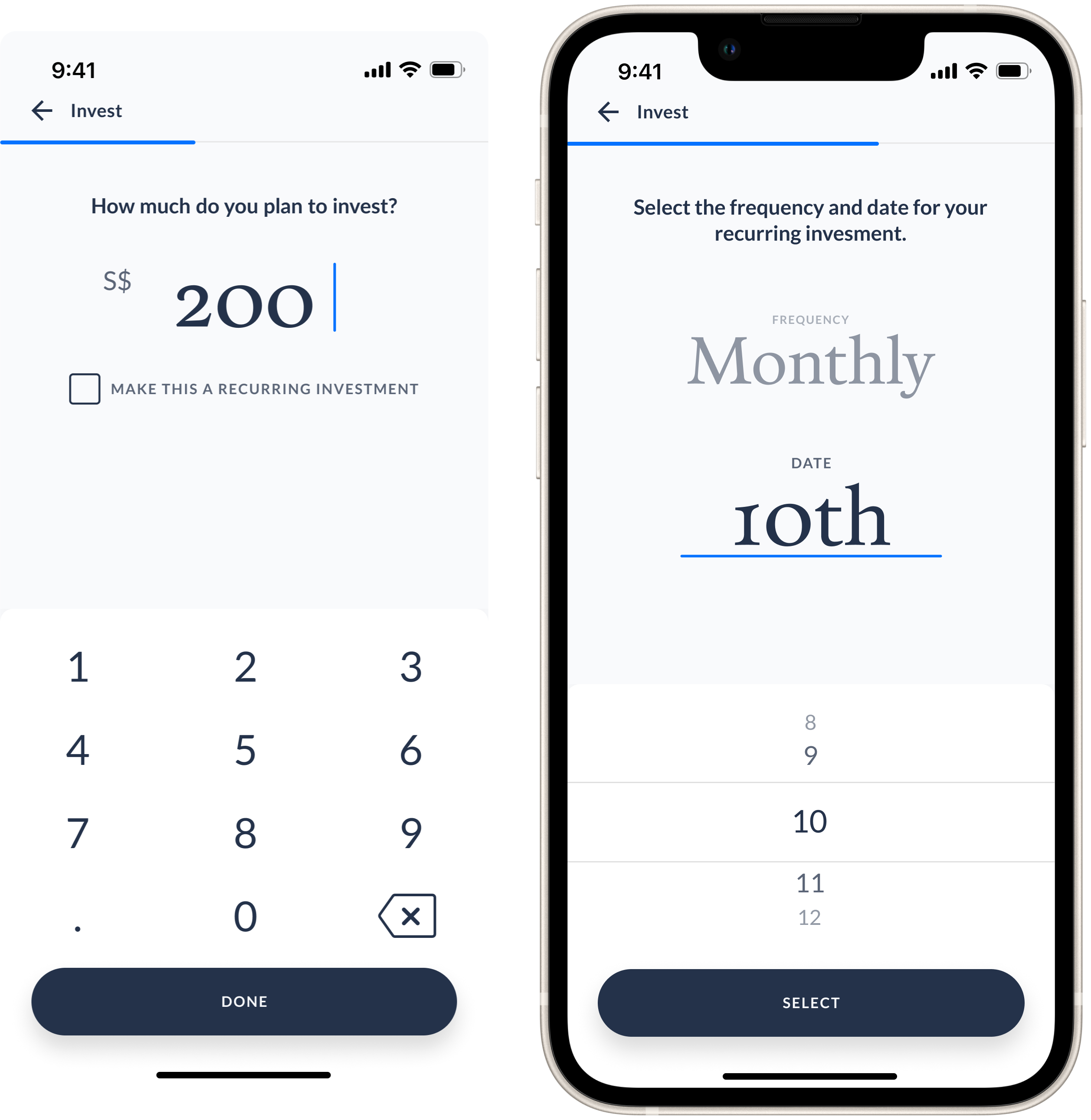

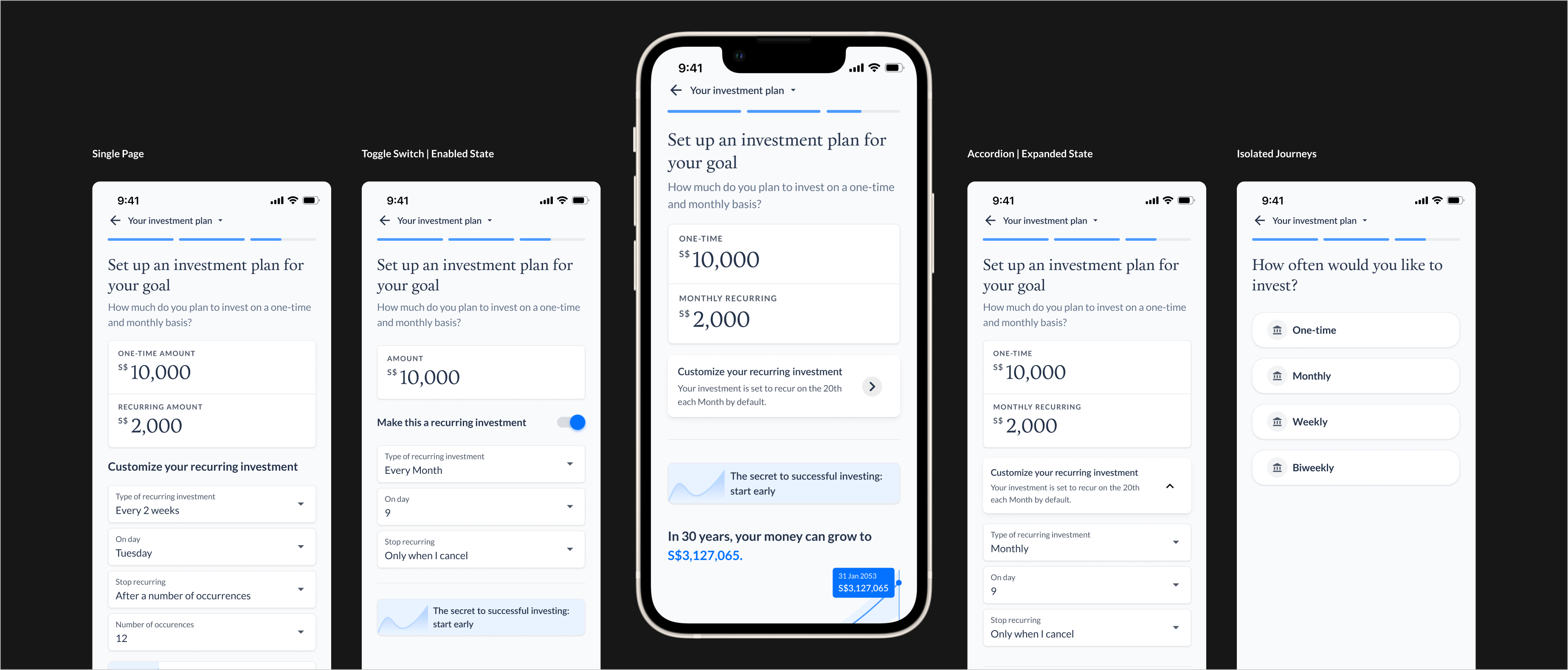

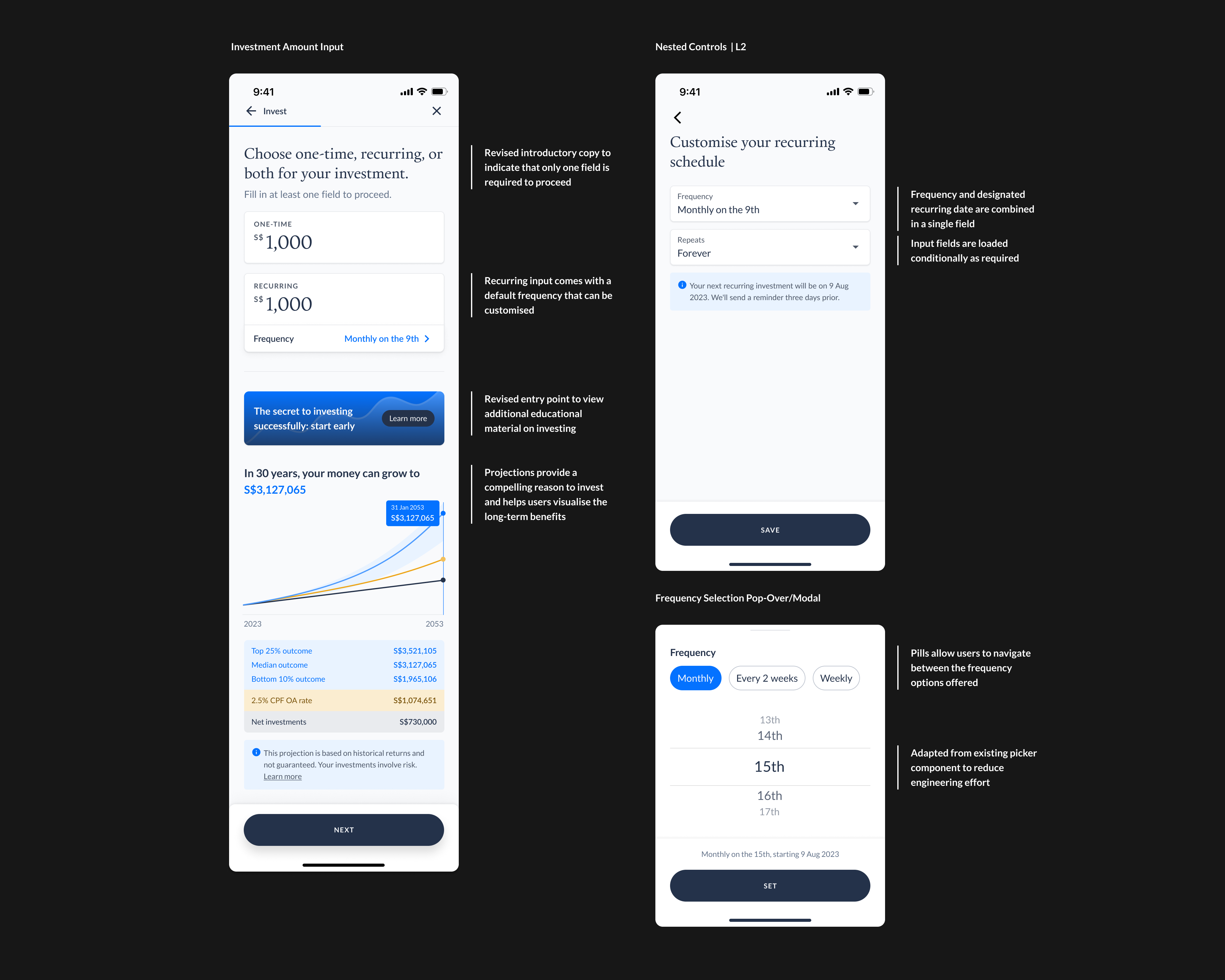

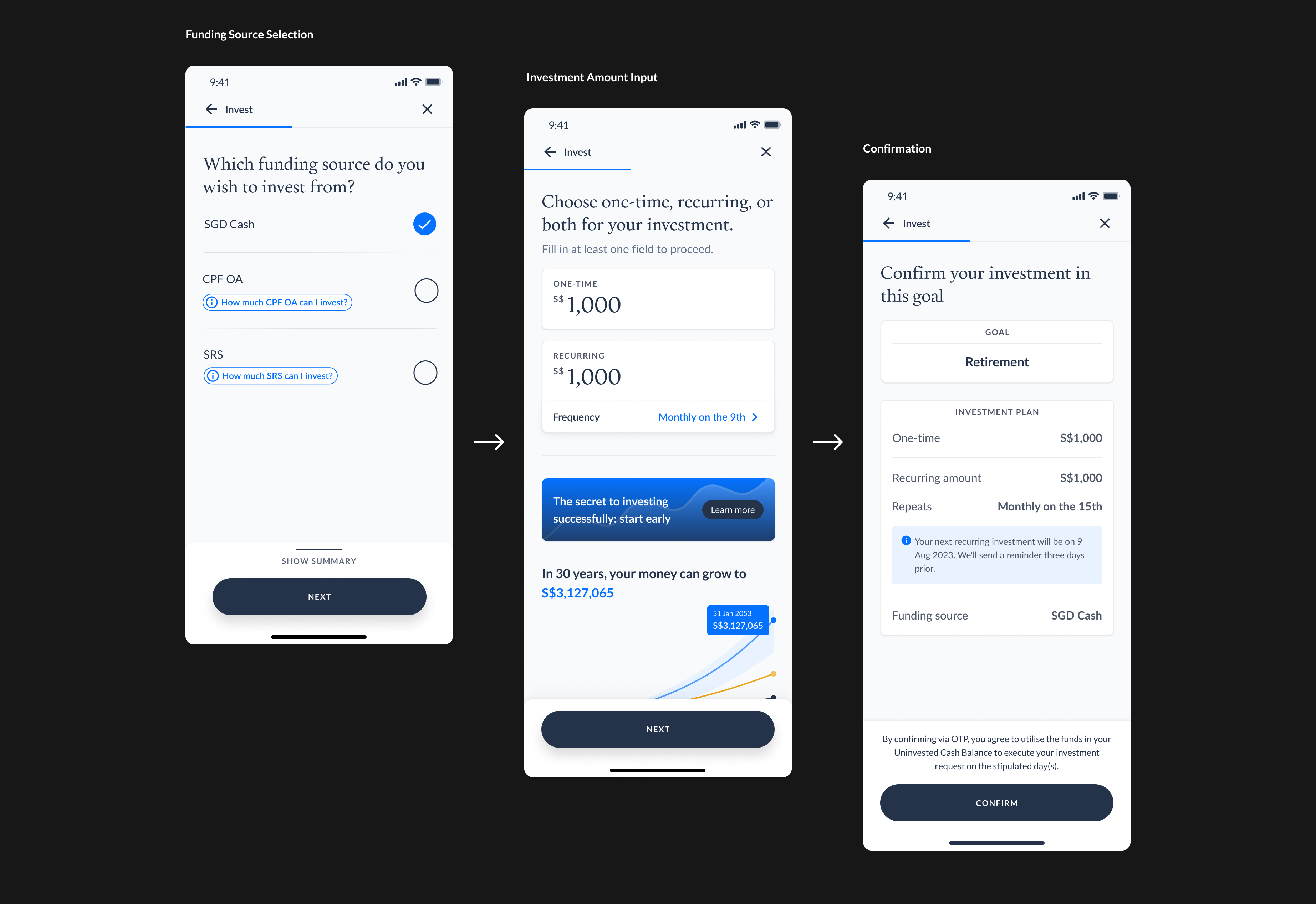

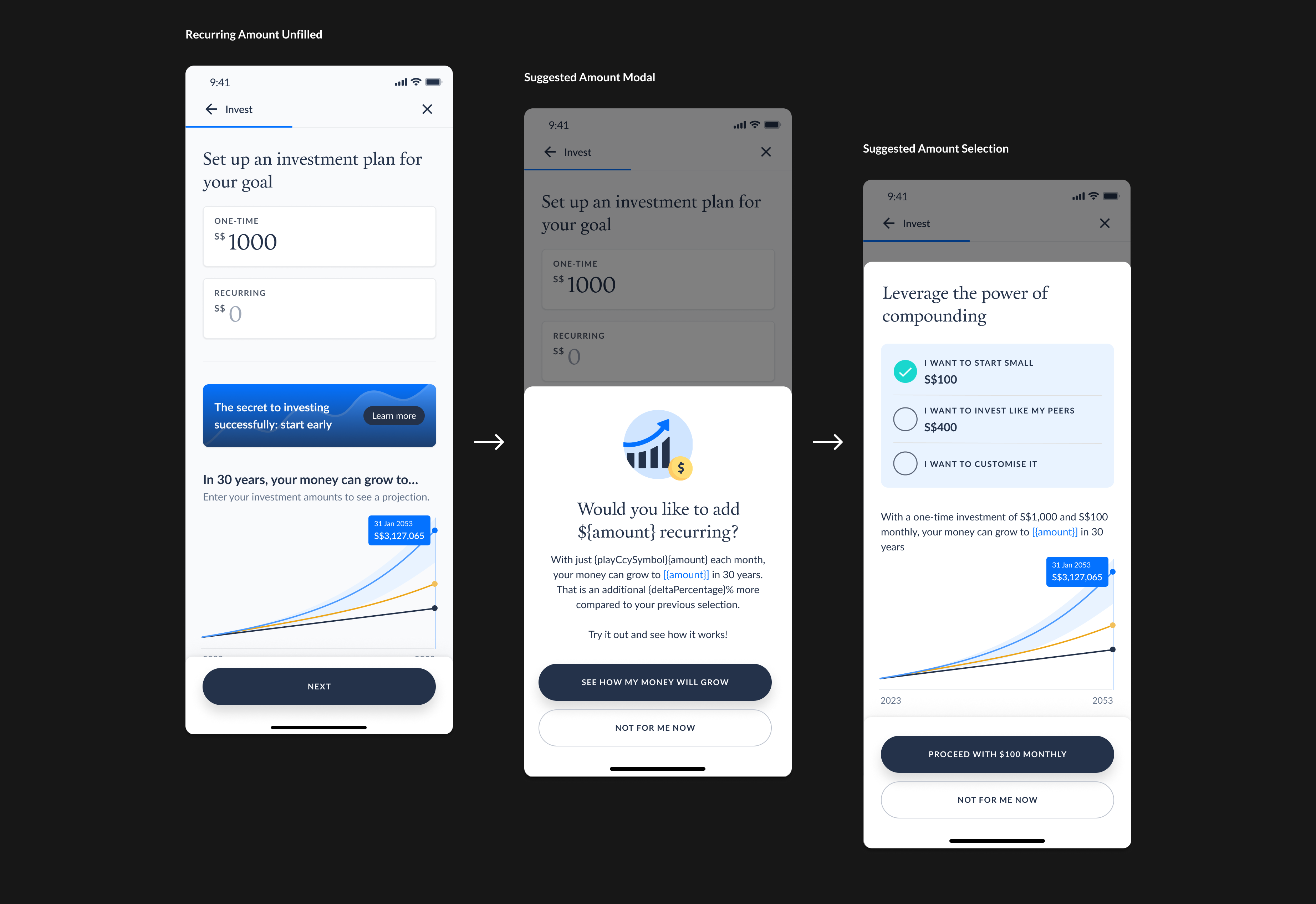

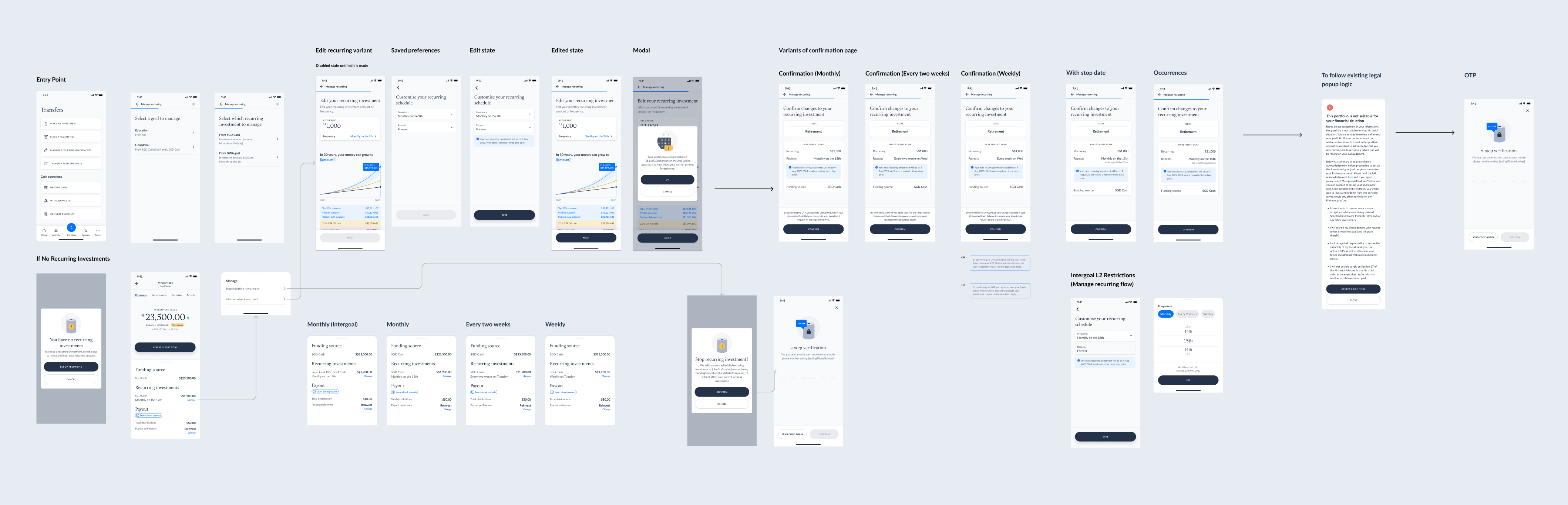

As a wealth management platform with a focus on long-term investing, the inclusion of recurring

investment features is crucial in assisting clients in making regular contributions towards their

financial goals. This functionality also benefits users by allowing them to navigate short-term

fluctuations and concentrate on building wealth through sustainable growth.